The New US Biosimilar Legislation, One Year LaterThe New US Biosimilar Legislation, One Year Later

About a year ago, President Obama signed into law the highly publicized health care reform bill known as the Patient Protection and Affordable Care Act. This legislation included the new Biologics Price Competition and Innovation Act of 2009 (now a “biosimilar statute”). Before enactment of that biosimilar statute on 23 March 2010, no “abbreviated” regulatory approval system existed in the United States for biologics — unlike Europe, which has had a system since 2005, and unlike US generic drug approval under the Hatch–Waxman Act of 1984.

Regarding a biologic product, applicants previously could pursue a nonabbreviated biologic license application (BLA) under the Public Health Service Act or a new drug application (NDA), a “§505(b)(2)” NDA, or an abbreviated new drug application (ANDA) (for approval of a generic drug) under the Food, Drug, and Cosmetic Act (FDC Act). The new statute created a pathway for Food and Drug Administration (FDA) approval of potentially “abbreviated” applications for biological products shown to be “biosimilar” to or “interchangeable” with reference products previously approved under a BLA.

The United States is still in the process of implementing its regulatory scheme for biosimilars. As stated by FDA commissioner Margaret Hamburg in November 2010, the FDA is at the “beginning of this journey,” and foresees that implementation will “be a dynamic process” that “will never be ‘done’” (1). What is clear right off the bat, however, is that like the European system, the US biosimilar regulatory scheme differs from existing regulatory pathways for generic small-molecule chemical entities. Especially in light of the complexity of biologics in many cases, the new legislation does not shoe-horn approval of biosimilars into the previously existing generic Hatch–Waxman scheme.

Market Exclusivity Periods

During the many years of debate over the biosimilar legislation before enactment, one big point of contention was the length of “market exclusivity” afforded to BLA holders; that is, the amount of time a BLA holder would have market exclusivity before approval of any biosimilar that references its product. The new legislation eventually established a 12-year period of market exclusivity from the date of licensure of a BLA product, which may be extended by six months of pediatric exclusivity (2). The first four years (or 4.5 years with pediatric exclusivity) is a period of so-called data exclusivity during which time an application for a biosimilar or interchangeable version of the reference BLA product may not be accepted for review by the FDA (3)

Certain innovators and members of Congress have asserted that the 12-year exclusivity itself concerns both market and data exclusivity (4). In response, generic supporters and other members of Congress have stated that the 12 years extends to market exclusivity only, with data exclusivity existing only during the first four (or 4.5) years, as discussed above. It appears that the FDA supports a reading that the 12-year period is a market exclusivity based on language used in a Federal Register meeting notice. We expect, however, that the agency’s proposed regulation will address this issue more clearly.

The 12-year market exclusivity blocks only applications submitted through the biosimilar pathway, however. No other BLAs are blocked by the 12-year exclusivity period.

The 12-year exclusivity period does not apply to a supplemental application filed by a BLA holder for the same biologic. The exclusivity period also does not apply to a subsequent application filed by a BLA holder or a “predecessor in interest, or other related entity” for (a) a change resulting in a new indication, route of administration, dosing schedule, dosage form, delivery system, delivery device or strength; or (b) a structural modification that does not change safety, purity or potency (5). The statute at least indirectly suggests that changes described (a) or (b) may qualify a modified biologic product for its own 12-year exclusivity period. That begs questions, however: What exactly suffices as a “structural modification” that changes safety, purity, or potency? The statute does not indicate what type of entity corresponds to an “other related entity” and would be therefore ineligible for another 12-year exclusivity period on a subsequent application. It is not yet clear how the FDA will address such issues.

Biologics also are eligible for, and may obtain, orphan drug exclusivity. Thus, if a BLA product is designated and approved as an orphan drug, then the FDA may approve an application for a biosimilar or interchangeable version of that biologic only after expiration of the later of any applicable seven-year orphan-drug exclusivity period or the 12-year market exclusivity period (i.e., 7.5 years and 12.5 years with pediatric exclusivity) (6).

A first-approved interchangeable biosimilar product also receives its own period of market exclusivity, which expires on the earlier of

one year after first commercial marketing of the interchangeable product

18 months after the resolution of patent litigation with the sponsor of the reference product

42 months after initial approval of the interchangeable product if patent infringement litigation is ongoing

18 months after approval of the first interchangeable biosimilar if the biosimilar applicant has not been sued for patent infringement by the sponsor of the reference product (7).

Interestingly, President Obama in his recent 2012 budget proposed a change to the legislation exclusivity beginning in 2012 to reduce the period from 12 years to seven. It seems unlikely that such proposal will gather much support in the current Congress (especially in light of existing debate about whether the 12-year exclusivity also extends to data exclusivity, which would ultimately extend market exclusivity even longer). With pressures to find savings in the budget, however, it is worth keeping an eye on this proposal to see if support for the measure grows.

Comparing ANDA and Biosimilar Patent Dispute Provisions

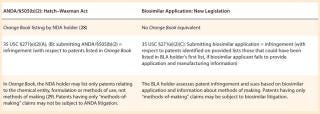

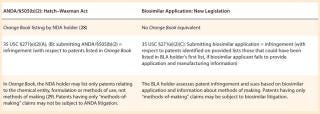

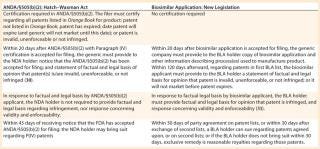

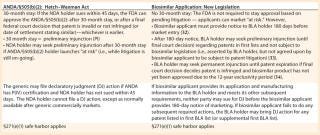

Tables 1A–1C compare certain patent law implications relating to filing an ANDA (or §505(b)(2) NDA) under the Hatch–Waxman Act, and the filing of a biosimilar application. These tables highlight some differences and similarities between both schemes.

Table 1a: Comparing ANDA and biosimilar patent dispute provisions

ter;” >

ter;” >

Table 1a: Comparing ANDA and biosimilar patent dispute provisions ()

Table 1b: Comparing ANDA and biosimilar patent dispute provisions

Table 1b: Comparing ANDA and biosimilar patent dispute provisions ()

Table 1c: Comparing ANDA and biosimilar patent dispute provisions

Table 1c: Comparing ANDA and biosimilar patent dispute provisions ()

Biosimilar Applications Trigger Patent Disputes

Like submission of an ANDA under the Hatch–Waxman Act, submission of a biosimilar application constitutes an act of patent infringement, thereby triggering a complex procedure for resolving patent disputes. But the biosimilar patent litigation procedure differs in significant ways from the ANDA patent litigation process (discussed in more detail below).

Process Exchange, First Patent Lists, Factual and Legal Basis

Under the new statute, submitting a biosimilar application sets off a requirement for an exchange of information between the applicant and the BLA holder. As an initial matter, within 20 days after the FDA has accepted its abbreviated application, a biosimilar applicant must provide the BLA holder with a copy of the biosimilar application and other information describing the processes for manufacturing the biosimilar product (8). The BLA holder must keep that application and information confidential and may only use such material to evaluate infringement (9).

Within 60 days of receiving the biosimilar application and manufacturing information, the BLA holder must provide the biosimilar applicant with a list (“first BLA list”) of all patents that the BLA holder reasonably believes are infringed, as could be asserted by either the BLA holder or a patent owner that has granted exclusive rights to the BLA holder (10). The BLA holder also must identify any patents on the list that it is willing to license to the biosimilar applicant (11).

Within 60 days of receiving the first BLA list, the biosimilar applicant may (but is not required to) provide to the BLA holder a list (first biosimilar list) of patents that the biosimilar applicant believes could be subject to a claim of patent infringement (12). The biosimilar applicant may list no patents, a subset of patents listed in the first BLA list, or additional patents that it hopes to litigate.

Within the same 60 days of receiving the first BLA list, regarding any patents listed in that or the first biosimilar list, the biosimilar applicant must also provide either (1) a statement describing, claim by claim, a factual and legal basis for an opinion that a patent is invalid, unenforceable, or not infringed; or (2) a statement that the biosimilar applicant does not intend to market until the patent expires (13). The biosimilar applicant must also provide a response to the BLA holder’s offer to license patents (14).

Within 60 days of receiving that material, the BLA holder must provide, regarding each patent discussed in statement (1) above, a reciprocal statement describing, on a claim-by- claim basis, a factual and legal basis for an opinion that a patent will be infringed as well as a response to any statement regarding validity and enforceability (15).

Negotiations, Exchange of Second Patent Lists, Patent Litigation

After the above-mentioned exchange of information, the biosimilar statute indicates that both parties must engage in good faith negotiations to identify which patents (if any) should be subject to patent infringement litigation (16). Notably, no deadline exists for starting these negotiations, but other deadlines stem from this negotiation process. If the parties reach an agreement within 15 days of beginning negotiations, the BLA holder may sue the biosimilar applicant within 30 days of such an agreement (18).

If the parties do not reach an agreement within 15 days, the biosimilar applicant must notify the BLA holder of the number of patents it will provide in a second list (19). Within five days of this notice, the parties must simultaneously exchange a list of patents that the biosimilar applicant believes should be subject to patent litigation (second biosimilar list) and a list of patents that the BLA holder believes should be subject to patent litigation (second BLA list) (20). The number of patents in the second BLA list cannot exceed the number of patents in the second biosimilar list, unless the second biosimilar list includes no patents, in which case the second BLA list may list one patent (21). At this point, the BLA holder may sue the biosimilar applicant within 30 days of exchanging the two second lists (22).

Within 30 days after a complaint is served, the biosimilar applicant must provide the FDA with notice and a copy of the complaint (23). The FDA will publish a notice of that complaint in the Federal Register (24).

If a new patent issues or is exclusively licensed to the BLA holder after it has provided its first BLA list, then the BLA holder has 30 days to provide a supplemental first list to the biosimilar applicant (25). After receiving this supplemental first BLA list, the biosimilar applicant has 30 days to provide its statement (1) and/or statement (2) (described above) regarding the newly listed patent (26). It is not clear that such patents are subject to the rest of the process described above, but they are at least subject to the 180-day notice provisions described below.

180-Day Notice Before Marketing

No later than 180 days before going to market with its biosimilar product, a biosimilar applicant must provide notice of that marketing to the BLA holder (27). This notice (discussed in more detail below) triggers the ability of the BLA holder to seek a preliminary injunction under certain circumstan

ces.

Strategies for BLA Holders and Biosimilar Applicants

Preparing a BLA Holder’s First Patent List: In light of the tight turn-around times for exchanging patent lists, it may make sense for a BLA holder to perform diligence early, creating and maintaining lists of all patents owned and licensed as relating to relevant BLA products. Such a company may want to assess the relative strength of applicable patents so that it can develop litigation strategy well before a biosimilar applicant files an application with the FDA. It is also worth noting that a BLA holder cannot sue a biosimilar applicant for infringement under this new statute regarding a patent that is not included in its first BLA list (unless a patent issues later, and the BLA holder timely lists it in a supplemental list), except potentially under limited circumstances. BLA holders may want to prepare patent lists in advance so that they can provide to biosimilar applicants a comprehensive first BLA list in the short time allotted.

Biosimilar Applicant’s Patent Lists: As noted above, if a BLA holder and biosimilar applicant fail to reach an agreement after entering negotiations after exchanging first patent lists, the biosimilar applicant must notify the BLA holder of the number of patents it will provide in a second list. Within five days, the parties then simultaneously exchange second patent lists. The number of patents in the second BLA list cannot exceed the number of patents in the second biosimilar list, unless the second biosimilar list includes no patents, in which case the second BLA list may list one patent.

Consequently, the biosimilar applicant determines the number of patents that may be litigated, with the caveat that the BLA holder may always sue regarding at least one patent. The biosimilar applicant does not control which patents are litigated, however. For example, if the biosimilar applicant notifies the BLA holder that its second list will contain two patents, then the BLA holder could potentially sue regarding four patents (two from each list). Specifically, four patents may be in play if it turns out that the biosimilar applicant and the BLA holder list entirely different patents during the simultaneous exchange of their second lists.

It is not clear, however, if parties will have any advance notice as to what each other may list in respective second lists. If one party tips its hand first, then the other party may strategically list patents to either shorten or expand the total number of patents to be litigated. As discussed below, however, choosing not to list patents in a second list may have consequences to the biosimilar applicant after it provides its 180-notice of marketing to the BLA holder.

Implications and Consequences

Implications of the 180-Day Notice: After receiving the 180-day notice of marketing from a biosimilar applicant, a BLA holder may seek a preliminary injunction prohibiting its market entry until a court decides patent validity, enforcement, and infringement with regard to patents listed in the first BLA or first biosimilar list, but not those agreed upon for patent infringement litigation or presented in second BLA and biosimilar lists. In other words, the BLA holder may seek a preliminary injunction in a second litigation only regarding patents not litigated in the first patent litigation (based on the list exchanges).

Consequently, the ability to seek preliminary injunction could affect how parties list patents in their respective BLA and biosimilar lists. For example, if a biosimilar applicant lists no patents in its second list, it runs the risk of being subject to a preliminary junction regarding unlisted patents, which could further delay commercial marketing.

If an Applicant Does Not Provide Information: Under the new biosimilar statute, soon after the FDA accepts its application, a biosimilar applicant must provide a copy of that and other manufacturing information to the BLA holder. Notwithstanding restrictions on the BLA holder to keep the material confidential and use it only to evaluate infringement, this requirement is not a trivial consideration. It could even deter an applicant from filing a biosimilar application at all rather than a BLA.

The new statute indicates that if a biosimilar applicant provides its application and manufacturing information to the BLA holder in a timely manner, neither party may sue for declaratory judgment (DJ) before the biosimilar applicant provides its 180-day notice of marketing. It is not abundantly clear, however, what happens if a biosimilar applicant refuses to provide that material after filing its application to the FDA. Section 271(e)(2)(C) indicates that, in that instance, the act of submitting a biosimilar application constitutes an act of infringement regarding patents that “could be identified” in a BLA holder’s first list. The language “could be identified” may refer to patents that the BLA could have listed in its first BLA list, assuming that it had the opportunity to assess the biosimilar’s application and manufacturing information. But who decides what patents “could be identified,” and under what circumstances? Do companies consider the biosimilar application and manufacturing information (not provided to the BLA holder) when assessing what patent “could be identified”? If so, how?

Even more confusingly, 42 USC §262(l)(9)(C) indicates that if a biosimilar applicant does not provide its application and manufacturing information to the BLA holder, then the BLA holder (but not the biosimilar applicant) may bring a DJ action regarding infringement, validity, or enforceability “of any patent that claims the biological product or a use of the biological product,” presumably even before the biosimilar applicant provides its 180-day notice of marketing. Notably, this language does not expressly refer to patents claiming methods of manufacturing the biologic in question. Certainly, relevant method-of-manufacturing patents “could be” listed in the BLA holder’s first list. But can a BLA holder bring a DJ action regarding such patents, or will it be limited only to those patents claiming the biologic itself or a method of its use, such as a method of treatment? This choice of language is particularly interesting when you consider that method-of-manufacturing patent claims are often the most relevant and valuable claims in a biologics context, especially as pertaining to safety and efficacy.

What Happens Now?

It is clear that the FDA now has the authority to accept, review, and ultimately approve license applications for biosimilar products. The agency is working to establish procedures and create mechanisms to review these applications.

As far as the public record indicates (and such activity may not be publicly known), the FDA has not reviewed any biosimilar applications so far. The agency held a well-attended two-day public hearing on 2–3 November 2010 to obtain input on specific issues and challenges associated with implementing the new biosimilar statute. It also accepted written comments until 31 December 2010. It is possible that the FDA may provide at least some written guidelines later this summer. The agency may attempt to prioritize how it addresses concerns, tackling the areas first where it deems certainty is needed most quickly.

BLA holders and biosimilar applicants are likely to encounter many issues as the FDA works through implementing the biosimilar approval process — requiring time, FDA guidance, and most likely court intervention. As part of such issues, the complex procedure for resolving patent disputes under the biosimilar system is sure to give rise to many questions. BLA holders and biosimilar applicants already are studying the statute to assess its provisions and incentives and identify loop-holes. As with its earlier counterpart, the Hatch–Waxman Act of 1984, when the FDA starts to implement the biosimilar statute ma

ny unresolved issues will certainly surface regarding execution and operation of the patent dispute provisions.

Although all such issues may prove challenging and complex, many experts predict that the business of biosimilars will grow significantly in years to come. With forecasts that a global market for biosimilars may reach $4.8 billion by 2015, a viable avenue to pursue “abbreviated” FDA regulatory approval of biologics is bound to have a significant impact on the biotech industry as a whole (40). It is a significant step forward that Congress has finally created a pathway for biosimilars.

About the Author

Author Details

Corresponding author Jacqueline Wright Bonilla, PhD, is a partner with Foley & Lardner LLP and a member of the firm’s Chemical, Biotechnology, and Pharmaceutical Intellectual Property, Litigation and Appellate practices and a member of the Life Sciences Industry team, 1-202-295-4792; fax 1-202-672-5399, [email protected]. Nathan Beaver is a partner with Foley & Lardner LLP and a member of the FDA Practice Group and firm’s Life Sciences and Medical Device Industries team, 1-202-295-4039; fax 1-202-672-5399, [email protected].

REFERENCES

1.) Heavey, S. 2010. No Finished Road for US Copycat Biologics. Reuters www.reuters.com/article/summit-fda-biosimilars-idUSTRE6A85A320101109.

2.)42 United States Code (USC) §262(k)(7), §262(m)(2) and (3) www.gpoaccess.gov/uscode/.

3.).

4.) Lendaris, S. 2011. Fine-Tuning the Generic Biologic Approval Process. Nat. Law J. 14:20.

5.).

6.) Patient Protection and Affordable Care Act, Pub L. No. 111-148.

7.).

8.).

9.).

10.).

11.).

12.).

13.).

14.).

15.).

16.).

17.).

18.).

19.).

20.).

21.).

22.).

23.).

24.).

25.).

26.).

27.).

28.) FDA’s Approved Drug Products with Therapeutic Equivalence Evaluations list (referred to as the FDA’s “Orange Book”.

29.).

30.).

31.).

32.).

33.).

34.).

35.).

36.).

37.).

38.).

39.).

You May Also Like