Keeping New Technologies ComingKeeping New Technologies Coming

June 1, 2013

The biomanufacturing industry is heavily invested in improvements in productivity and efficiency, and innovation is a critical component to ensuring gains in these areas. Yet that is not always the case. Suppliers and innovators in this market face greater challenges, and much longer product evaluation cycles than in other segments, for example the information technology or semiconductor industries. In the highly regulated biomanufacturing environment, changing any aspect of a process can potentially necessitate additional regulatory submissions to the US Food and Drug Administration (FDA) or other regulatory agencies. Any innovation or change to an existing process needs to be considered in terms of the regulatory aspects of adopting a new technology.

We asked our Biotechnology Industry Council to weigh in on the challenges of introducing new technologies (1). More than 300 senior biomanufacturing participants considered the question “What are the biggest problems you face in getting a supplier’s new innovation into your internal evaluation process?” Typical end users’ perspectives included the following

There should be an obvious technical and operational need to justify the evaluation.

We won’t evaluate any technology that is not proven in industrial scale.

We don’t want to consider a new technology until it is “ready for prime time,” including compliance with current good manufacturing practice (CGMP) or 21 CFR Part 11.

It needs to fit our product portfolio and immediate technology needs.

Many innovations lack convincing data that the technology even works.

There needs to be a justifiable scientific rationale.

We need to be clearly shown how easy a new technology will be to integrate.

Many great innovations are available that we can get excited about, but vendors/inventors often fail to relate them to our specific needed applications.

Innovators need to specifically define the impact on our internal drivers.

Figure 1:

So simply to invent a “better mousetrap” is not a compelling reason to adopt a new technology in this industry. On the other side of the equation, to gain vendors’ perspective, we asked “What is the biggest challenge to your new product development team when getting your new technologies and innovations into the hands of potential end-users?” Comments included the following:

Introducing new technologies to end-users requires allowing step-changes in innovation. New technologies can’t be too different from existing processes.

Time for implementation can be prohibitively long, so it is easier to implement incremental process changes.

The biggest challenge to innovation is the intrinsic conservatism of the biopharmaceutical industry. Tried and true is often chosen over innovative technologies, unless a specific problem is being addressed.

New techniques need to be much better than existing ones to justify a change.

New bioprocessing technologies face slow adoption rates because of several challenges. These include hesitance of bioprocess development scientists to commit time and resources to evaluating technologies that are far from commercialization; an enormous effort required to execute change control to get a new material or operation introduced into a registered process; and barriers to radically innovative technologies that do not fit current paradigms of health authority regulations.

Ongoing, frequent collaborations help suppliers understand customer needs. Rigorous cost-modeling of innovative processes and proactive involvement with industrial consortia and regulatory bodies are key steps that innovators must provide to increase adoption of new technologies by end-users.

Figure 1: ()

Product Innovation Issues

Our interviews suggest that most suppliers and innovators are aligned in their understanding of the adoption process. According to one respondent, “End users and regulators often must be compelled to accept new technologies by demonstrating that they provide at least a comparable assurance of patient safety.” That creates common ground, and a regulatory focus shared among end-users and the new technology innovators. It can establish a mandate that pushes a more collaborative approach to new product development.

The situation is particularly apparent in areas such as single-use devices. Currently, single-use (plastic-based) equipment dominates precommercial biopharmaceutical manufacture. Products for preclinical and clinical studies are often made in single-use bioreactors and (increasingly) downstream purification equipment. However, essentially all current marketed biopharmaceutical (commercial-scale CGMP) manufacture involves use of fixed bioreactors and other stainless steel equipment. Precedents for approvals are negligible in the United States, European Union, or other major markets for biopharmaceuticals manufactured primarily using single-use equipment. Developers establishing the viability of single-use bioprocessing equipment for commercial product manufacture are likely to experience delays in the processing of their regulatory applications. That experience can act as a disincentive for others.

Regulatory concerns are an important aspect of considering the further penetration of single-use equipment. Year after year, lack of standardization is a key reason reportedly holding back increased adoption of single-use devices. Once concerns regarding leachables and extractables, particulates, and other crucial elements are tackled, penetration of single-use devices into commercial-scale manufacturing and applications will increase significantly in number.

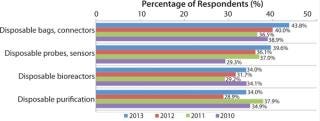

Fueling that expansion will be a continued desire of the biopharmaceutical industry for new disposable products. Despite the regulatory concerns addressed above, the industry remains keenly interested in innovation in single-use equipment. In our 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production (2), we asked biomanufacturing respondents to identify the key areas in which they want their suppliers to focus new product development efforts.

The largest portion of respondents this year cited disposable bags and connectors (43.8%) followed by disposable probes, sensors, and so on. (39.6%), disposable bioreactors (34%), and disposable purification (34%). What’s more, interest in each of those areas increased from 2012 to 2013, suggesting that the industry might be becoming more confident that regulatory solut

ions are en route for aspects of single-use equipment introduction.

Can Vendors Supply the Goods?

Meeting industry demand for innovation is a tricky equation for vendors. On one hand, the industry clearly shows a desire for innovation. Yet on the other hand, biomanufacturers are cautious about introducing new products into their processes, particularly at commercial stage. Step-wise innovation is how many vendors introduce new technology to avoid regulatory challenges of being “too different from existing processes.” But that can dramatically increase time for introduction (delaying revenue to suppliers for their innovations).

An example is the predominant single-use paradigm of adding multilayer plastic laminate bags or liners to essentially classic-design stainless steel bioreactors, mixers, and other fluid containers. This is a less radical way to introduce single-use products into a manufacturing process. Most major vendors are committed to this approach, with some having in recent years invested very heavily in costly bag-making manufacturing facilities. Those companies, including market leaders, will by necessity be committed to current (rather than more innovative) product lines and this paradigm for at least the next few years.

Vendors’ Areas of Innovation

The answers were not too much of a surprise when we asked vendors participating in our 10th annual study to identify top new technologies or new product development areas their companies are working on in biomanufacturing. The largest proportion (37.8%) pointed to some aspect of single-use bioreactor bags and consumables (on par with the percentage citing bioprocess development, optimization services, and bioprocess modeling).

Although it appears on the surface that vendors are simply meeting thedemands of end-users for innovation in single-use equipment, the nature of the “bag in a stainless-steel bioreactor” and many other current single-use equipment designs restricts opportunities for innovation and new product introductions. So although vendors may be innovating in the right areas, they could be in danger of pursuing less innovative products.

Current vendors tend to be effectively unable to significantly upgrade existing product lines once introduced. Product upgrades risk serious concerns for a current customer base, particularly if current products are phased out. Vendors also know that any bioprocessing product change requires considerable expense and work. That includes ensuring that it works in specific applications and may require modifications of regulatory filings, standard operating procedures (SOPs), training, and (perhaps worst of all) potentially another round of validation testing. That can cost as much as US$100,000 for each plastic product that has significant contact with a drug product (required for approvals).

In addition, actions such as changing a plastic resin may create other problems if production operations are affected or in the instance of a quality failure. Testing for leachables and understanding how they can affect biologics is challenging. Once a biopharmaceutical product is approved, the sponsor company will be resistant to change because it is difficult to prove that a new plastic does not negatively affect a drug product molecule. All such factors combine to make the pathway to innovation somewhat inflexible.

What Lies Ahead?

Taken together, the data suggest that although the bioprocess industry claims to want innovation (particularly in single-use equipment), game-changing innovations might not be right around the corner. That’s not too surprising: It’s an understandable by-product of a cautious, highly regulated industry in which millions of dollars can be at stake with every decision. So it is possible that the next wave of major innovation — which could involve new and better materials that facilitate improved designs — may well come from smaller vendors or larger outside entrants, particularly for novel single-use products such as bioreactors (in which developers continue to show an interest). Those companies may be better positioned than those with firmly entrenched product lines.

Survey Methodology

The 2013 Tenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from over 300 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 29 countries. The methodology also included over 180 direct suppliers of materials, services, and equipment to this industry. This year’s study covers such issues as new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It evaluates trends over time and assesses differences in the world’s major markets in the United States and Europe.

About the Author

Author Details

Eric S. Langer is president and managing partner at BioPlan Associates, Inc.; 1-301-921-5979; [email protected]; www.bioplanassociates.com

REFERENCES

1.) 2013.Informal e-Survey of 350 biopharmaceutical manufacturing decision makers on Biotechnology Industry Council.

2.).

You May Also Like