How to Justify Investment in AnticounterfeitingHow to Justify Investment in Anticounterfeiting

Pharmaceutical products are critical to the social, economic, and political stability of societies around the world. No other business sector is more dependent on consumer confidence. Like food products, drugs are highly vulnerable to deliberate and/or accidental disruption. A small tablet has almost no intrinsic value on its own; its value derives from the pedigree of its manufacturer and the belief that the pill will change someone’s life for the better. Manufacturers hold a sacred trust (given them by their customers) to provide safe and effective therapeutic products. Counterfeit drugs breach the promise that is carefully established by the legitimate healthcare industry.

Threats the pharmaceutical industry faces in our “post–9-11” era are categorically different from those of a decade ago — but they are quite similar to those of two decades ago. In 1982, seven innocent people died in Chicago as victims of a criminal (never identified) who replaced the Tylenol pain reliever in over-the-counter capsules with cyanide (1). Massive retooling, major reinvestment, and new federal laws followed. No one questioned the need. Halfway around the world, Japan experienced a similar tragedy. The Japanese Red Army (JRA) poisoned consumer products and put the poisoned containers on store shelves, and again, new national quality standards emerged.

Figure 1:

WWW.PHOTOS.COM

The 1982 deaths in Chicago and the JRA attack in Japan were certainly not linked to the respective manufacturers, but those manufacturers lost market share and bore the consequential burden. With a view to those costs, we present a simple, quantitative risk-analysis tool to justify capital investment in equipment and technology to help ensure that history does not repeat itself on our watch.

Defense is a fundamental precept of package engineering and marketing. Breakage and environmental protection (preventing degradation from water or oxygen) go hand in hand with brand identification and consumer attention. But as we cautiously enter a new environment in which counterfeiting, diversion, and tampering occur at ever-increasing rates, professionals will need to focus their shrewd talents on setting up a defensive framework for easier detection to make counterfeiting more difficult and in turn protect consumers as well as companies. Investment in this area cannot be readily quantified as simply “cost-justified” capital.

The Business Case

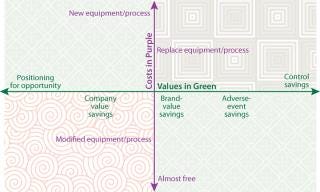

Finance departments break costs down into a multitude of categories. To simplify matters, we identify four primary categories. The elements of each that must be further quantified include equipment cost, integration cost, and on-going material costs:

New equipment/process, necessarily encumbered with associated costs and usually driven by an expected return on investment (ROI)

Replace equipment/process, driven by need and may offer cost synergies

Modified equipment/process, driven almost entirely by efficiency

Almost free — the little tweaks that piggyback onto project budgets or come from special circumstances.

We are all familiar with the ROI concept and apply different modalities of promising “return” as we package up our presentations to management. Justifying investment against unknown threats such as terrorism invokes tangible and intangible savings that are often not obviously measurable. Such savings include control savings (immediately measurable in operational costs), adverse-event savings (accrue when accidents don’t happen), brand-value savings (captured by not losing customers), company-value savings (when loss of market credibility, lawsuits, bankruptcy, and foreclosure are precluded), and a less apparent and inverse value of positioning for opportunity. Tangible benefits include improved changeover, greater reliability, fewer “damage” and “expired” returns, increased sales because of better market appearance (better than it would otherwise have been), and specifically fewer counterfeit/diversion losses.

Costs diminish linearly from “new” to “almost free,” and quantifiable values diminish linearly from “control” to “opportunity” (Figure 1). These savings indices matrix very effectively with the cost categories and could easily provide a nice two-dimensional representation of relative value. Our focus here is directed to anticounterfeiting and antitampering investment. This will necessarily fall into the more nebulous quadrant of the matrix. So greater specificity regarding risk must be factored into the equation.

Figure 1: ()

Control savings are the most readily quantified. They include inventory reduction and more efficient throughput, which prevent stock-outs and facilitate better sales tracking. Antipilfering improvements decrease shrinkage and allow a company to capture current lost sales. Track-and-trace technology holds great promise here.

At one of our past employers, we encountered an interesting situation with a very biologically active hormonal product. As an aerosol dispersal, it was prone to abuse. In the market country, we began experiencing high rates of customer returns for short fills (fewer doses than labeled). Because the process was validated, proven dependable, and carefully monitored, the problem was surmised to be due to tampering within the supply chain. Track-and-trace methods allowed the company to identify “inappropriate misuse” by pharmacists. The very fact that such misuse could be identified through a controlled supply caused it to cease without the need for legal recourse.

Adverse-event savings, brand value, and company value are best visualized in the context of recalls. The costs of a recall go far beyond logistical efforts and include management overhead, special services, tarnished image, and lost market share. Counterfeits entering the supply chain present the same sort of risk.

In the very late 1990s, G.D. Searle & Company (now part of Pfizer) was preparing to launch a blockbuster drug in a South American market country. Management expected that there would be counterfeits. Consequently, the company chose a very different path to discourage them. In all its market launch product literature to physicians, packaging was displayed that was like the forthcoming product, but not exactly the same. The literature’s packaging format was copied, as expected, and fake product appeared on the market two weeks before the Searle launch.

However, when the true market launch did occur, fraudulent products were instantly identifiable and refused by consumers. As for the counterfeiters and everyone involved in their malevolent supply chain, they were stuck with less than worthless inventory because the very possession of it made them a target for subsequent contract and law enforcement efforts. The adverse counterfeiting costs routinely suffered by other companies did not affect that particular Searle product. Those who would have applied a less enlightened ROI view toward the additional resources needed for such a faux product presentation and additional rollout literature may not have approved such an approach.

Positioning for opportunity is an elusive target. Looking back to the 1960s, there was a fairly well defined artificial sweetener market. One company dominated with a cyclamate product, and many companies were competing for the smaller saccharin market. One of those saccharin companies invested in high-speed filling-packaging machinery — against prevailing market trends. It also thoroughly analyzed and controlled its supply chain so that it could ensure no stock-outs (which allow competing products to usurp distribution channels and customers). When the FDA banned cyclamates in 1967, that clever saccharin company was able to immediately deliver enough quantities to fill the void and consequently achieved a dominant position that it maintains to this day (those ubiquitous pink packets).

After the Tylenol incident in 1980s, a number of copycat crimes occurred. At that time, two companies dominated the eye-drop market with 60% and 30% market share respectively. The one with the smaller share converted all of its products to antitamper packaging within 60 days of the Tylenol incident. Soon afterward, eyedrops laced with sulfuric acid began appearing in non–tamper-evident eyedrops. The market share reversed itself. The smaller brand doubled its sales, whereas the larger one’s sales fell to half their previous level. That year, hefty bonuses were paid out in one company, and the other was forced to not only respond to the injuries, but also buy new capital equipment, implement supply chain improvements, and invest additional resources to recapture its dominant brand position over the following years.

Application

In a “status quo” environment, cost savings alone will not justify incremental costs of protecting a supply chain. But circumstances, real or imagined, can dramatically shift a company’s liability posture. Risk managers call such circumstances risk, which is simply defined as “the possibility of loss, injury, disadvantage or destruction.” From a given organization’s perspective, failure is anything accomplished in a less than professional way and/or with a less than adequate result that could negatively affect strategic goals. Failure with antitampering or anticounterfeiting could lead to the loss of innocent lives.

Back in 1981, there was no delineated ROI for adding tamper evidence to OTC products. Following the poisoning incident, many products were pulled from the shelves, sales volumes fell, competitors with tamper-evident packaging increased their sales, and company legal counsels began receiving notification of lawsuits. After an appreciable hemorrhage of brand and company value across the industry, the value of making these problems go away became so compelling that ROI for tamper-evident packaging was hardly even considered.

Clearly the smarter approach is to proactively quantify the risk and value of adverse events to fund projects before an adverse event takes place. We need to capture the value of bad things not happening — before they happen.

A FIVE-STEP TOOL

Step 1

Step 1A: Brainstorm to develop a list of potential root causes.

Step 1B: Sort list into groups that eliminate redundancy (brainstorming activities can generate several variations of the same root cause).

Step 2

Step 2A: Assess the possibility of an untoward event occurring. Score 1–10 (“1” means highly unlikely; “10” means a sure thing).

Step 2B: Assess the effect or impact of an untoward event on the product. Score 1–10 (“1” means highly unlikely; “10” means a sure thing).

Step 2C: Assess the ease with which a situation could be corrected. Score 10–1 (“10” means almost effortless; “1” means almost impossible).

Step 2D: Multiply those scores (possibility × effect × ease) and calculate the resulting value.

Step 3

Tabulate and rank potential causes based on the value calculated in Step 2D.

Step 4

Calculate the financial quantification of causes using % event elimination (% possibility) × $ value of adverse event = savings.

Step 5

Roll up (bundle) all savings.

Our Tool: The most common risk management activities are risk identification and ranking. Ideally, the desired tool for this would serve as a coordinating instrument for the individual risk management activities of other functions within an organization — a defacto technical resource — and operate as an information gathering and assessment instrument for management on totality of risks. They must be individually identified based on product and distribution practices. Once risks have been identified, a scoring system is applied.

As described in the “Five-Step Tool” box, a simple tool used properly can help quantify the values described herein. To facilitate explanation, we choose not to encumber ours with supply chain complexity and instead chose a common “adverse event” that has been experienced by most readers: a prepared Microsoft PowerPoint presentation that doesn’t work when needed at a meeting. If a presentation doesn’t work, you can identify several potential causes (Table 1): improper hardware installation, improper wiring connection(s), a software virus, and an untimely gremlin visit (a whimsical outlier to show how this tool can quantitatively deal with remote possibilities).

Table 1: Possible causes of presentation failure

Table 1: Po

Return on Investment: Using our simple five-step tool, you can capture and rank relative risk scenarios as part of an overall risk management exercise. This enables companies to focus valuable resources on those areas most needing such investment. Along with this ranking, there remains a need to capture costs and capture ROIs — both tangible and intangible.

Control savings are typically difficult to calculate prospectively. However examples abound in other company areas as diverse as “RFID justification” to “enterprise management systems” to systems integration projects. Areas to focus on range from inventory on hand, expired product write-offs, minimized product leakage, reclaimed sales from counterfeit products, and minimized diversion losses.

To calculate actual ROI for adverse event prevention, a more sophisticated approach is needed: Σ patient failure + additional health costs + adverse event report costs = ROI. For brand value savings, calculate Σ lost sales + infrastructure loss + loss of marketing slots and shelf positions = ROI. For company value savings, calculate Σ lost sales of other products + recall + lawsuits + delayed product approval + lost opportunity (special overhead applied) + % cause elimination (% possibility × $ value of adverse event) = no adverse event savings. And in positioning for opportunity, calculate Σ % chance of adverse event to competition × potential sales/profit increase.

The Bottom Line

Interest in the pharmaceutical industry for measuring and managing operating risks has risen over the past several years. There is a growing realization that an enterprise-wide view of risk management is just “good business.” For sound disaster planning and business continuation, supply chains must be fortified, so compelling cases for appropriate investment must be made. In the lexicon of many companies, that suggests that humanitarian justification must be turned into financial justification. The critical objective for risk managers is to develop a “structural” model of risk that captures the cause-and-effect relationships among risk factors and outcomes.

The anticounterfeiting potentials of many technologies (e.g., barcodes and traceability controls) are often used for other purposes. Ownership of the technology within a company can be fragmented. Different identification systems often do not interface and may require manual conversion to achieve connectivity — and the ability to connect them decreases as products move farther down the supply chain.

Quality assurance (QA) groups have been effectively underwriting operational risk in the pharmaceutical industry since the advent of good manufacturing practices (GMPs). QA and operations groups are actually mandated by regulation to ensure that effective control is exercised over production and use of components and packaging materials as well as disposal of samples and materials rejected during production. The deliberate unity of effort between these functionalities provides a defense in depth. Without that unity and central control, changes in personnel, designs, process optimizations, and cost reductions can innocently undermine preventative measures enacted previously. Close examination of many over-the-counter products today will reveal fewer deliberate antitampering features than were seen in 1985.

In the new anticounterfeiting landscape, prudent companies recognize not only the individual and corporate risks under strict liability, but also the increasing threats to consumers. Counterfeits rob companies of their profits, destroy consumer confidence, and could even harm or kill consumers. But most important to those on the line, failure to preclude counterfeiting (wherever it can reasonably be expected and wherever potential harm can be expected) could easily become a corporate liability. Our final caveat is this: Tools in the hands of the unskilled are dangerous, and any systemic applications of risk modeling must be coordinated. Counterfeit drugs kill people, so a simpler approach might be to ask simply, “How much is a human life worth?”

REFERENCES

1.) Babwin, D. 2007.Tylenol Tampering Case Unsolved at 25 Associated Press.

You May Also Like