In the Industrial ZoneIn the Industrial Zone

April 1, 2008

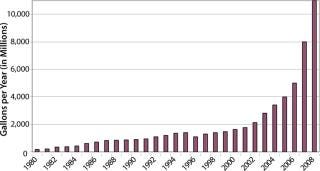

Figure 1.

The same genomic and proteomic technologies used to discover new drugs and therapeutics are also changing the way we live and some of the products we buy. Technologies have yielded new enzyme biocatalysts, used in producing raw and intermediate materials and consumer products. In addition to improving crop and food production, companies are using the tools of biotechnology to manufacture materials from renewable and sustainable resources, build environmentally sound industrial processes, and develop innovative solutions to growing global energy needs.

“The renewable fuels and fuel efficiency standards that are now law have created a huge opening for advanced biofuels in the US transportation fuel markets,” said Brent Erickson, executive vice president for the Biotechnology Industry Organization’s (BIO’s) Industrial and Environmental Section, at a recent press conference.

“Make no mistake about it,” he stated. “This will be an ongoing project larger than both the Manhattan Project and the Apollo Project combined.” In fact, it’s already big: Top-tier auto maker General Motors announced in January at this year’s North American International Auto Show in Detroit, MI, its partnership with Coskata Inc.(www.coskata.com) to run its fleet of vehicles on ethanol made from nonfood sources.

EXHIBITORS IN THE INDUSTRIAL PRODUCT FOCUS ZONE

Almac (Booth #2736): www.almacgroup.com

Roche Colorado Corp. (Booth #2639): www.rochecolorado.com

Sandoz (Booth #2631): www.sandoz.com

Sentry Logistic Solutions (Booth #2730): www.SentryLogistic.com

Solvias Inc. (Booth #2635): www.solvias.com

SouthernBiotech (Booth #2732): www.southernbiotech.com

US Department of Energy Genomics: GTL Program (Booth #2734): http://genomicsgtl.energy.gov

Technology and Policy Matters

The confidence that underlies such an announcement is not just the result of recent and ongoing developments in biofuel technology, but also of some solid thinking and action by legislators regarding energy policy and the role being assumed by biofuels.

On the technology front, however, great strides have been made recently in processes to make ethanol from cellulose using stalks as feedstocks, and pilot-scale refineries are being put into operation.

“Biorefineries producing not just fuel, but also chemicals and energy can be built throughout the United States, using locally available cellulosic biomass feedstocks,” said Erickson. Industrial biotechnology enzymes called cellulases will be used to produce billions of gallons of ethanol transportation fuel from not only corn kernels, but also corn stalks and leaves — the cellulosic biomass — which will boost economic activity by allowing farmers to harvest two crops from a single field. Biorefineries will also create jobs in rural areas where they are especially needed.

“These small-scale projects will use a wide variety of feedstocks and test many different technologies for fuel and coproducts, providing experience and data that can be transferred to full-size, commercial-scale biorefineries,” Erickson said.

Plant science researchers Jose Gonzalez (left) and Arvid Boe (right) are studying prairie cordgrass as a potential biofuels crop — one aspect of a Sun Grant award to fund research at South Dakota State University ()

Biofuel Target

And that’s just in time. Advanced biofuels underpin our ability to meet aggressive greenhouse-gas reduction targets in the United States and elsewhere. The recently passed Energy Independence and Security Act of 2007 (1), for example, calls for production of 21 billion gallons of advanced biofuels by 2022.

The US Department of Energy (DOE) is hardly alone in funding biofuels research. The Sun Grant Initiative, a national network of land-grant universities and DOE labs partnering to build a biobased economy, for example, is targeting the front end of the biofuels production line: feedstocks (2).

South Dakota State University in Brookings, SD, announced last fall that it had landed a grant approved through the North Central Sun Grant Center based at the university. Project director William Gibbons leads a university-industry team working to develop sustainable feedstocks and next-generation processing technologies for biofuel production.

“We’ll not only be developing innovative technologies in three areas — feedstock, pretreatment, and conversion — but will simultaneously address the cost and energy issues critical for commercialization,” Gibbons said in an announcement.

Commercial Biorefineries: The four-year project will receive $1 million in funding through the Sun Grant Initiative, plus $100,000 annually from each of two companies, for total funding of $1.8 million. The private-industry participants are renewable-fuel producer VeraSun Energy Corp. (Brookings, SD, www.verasun.com) and refinery supplier and technology provider ICM Inc. (Colwich, KS, www.icminc.com), which is at the forefront of development efforts for cellulose-processing ethanol plants.

ICM has also received funding from the Department of Energy to lead biomass-to-ethanol research efforts using various feedstocks and conversion technologies to subsequently deliver online full-size, commercial-scale biorefineries. The DOE will invest up to $114 million over four years in these projects, with the goal of making cellulosic ethanol cost-competitive in five years. Other funding recipients include Lignol Innovations Inc. (www.lignol.ca/index.html), Pacific Ethanol Inc. (www.pacificethanol.net), and Stora Enso North America (www.storaenso.com).

ICM said it plans to use corn fiber, switchgrass, corn stover (the corn stalks not currently being used as biomass), and sorghum as feedstocks, integrating biochemical processing and demonstrating energy recycling within the biorefinery. A proposed plant location in St. Joseph, MO, is uniquely positioned to fulfill the DOE project requirements cost-effici

ently, according to the company. Early plans call for a pilot-scale biorefinery to be constructed adjacent to an existing 50-million-gallon/year ethanol facility. Much of the necessary infrastructure (road, rail, water, electrical, utility, and wastewater treatment) already exists, eliminating significant capital expense.

An industrial biotechnology workhorse: the DuPont Tate & Lyle Bio Products Bio-PDO facility in Loudon, TN ()

Likewise, advanced energy company AE Biofuels Inc. (Cupertino, CA, www.aebiofuels.com) announced in February that it has begun construction of an integrated cellulose and starch ethanol demonstration facility in Butte, MT. The plant will use the company’s proprietary ambient-temperature cellulose starch hydrolysis enzyme technology to optimize process conditions for multiple feedstocks. Nonfood feedstocks are expected to include switchgrass, grass seed straw, small grain straw, and corn stalks alone and in combination with traditional starch and sugar sources. The 9,000-ft2 plant is expected to be fully operational by the second calendar quarter of 2008.

No Cooking

In 2007, AE Biofuels acquired enzyme technology from Renewable Technology Corp. and formed its ethanol technology subsidiary, Energy Enzymes. The company’s enzyme technology is intended to reduce operating and capital costs for both cellulosic ethanol and starch ethanol plants, and it provides a platform to integrate the two processes. Ambient-temperature enzymes eliminate the up-front “cooking” process of traditional starch ethanol production, the company said.

Eliminating that cooking and cooling process reduces both energy and water consumption. In addition, the cellulose enzyme technology has proven successful in converting such multiple-lignocellulosic feedstocks as switchgrass, wheat grass, corn, and corn stover, to ethanol. The multiactivity enzymes are expected to reduce capital and operating expenditures for cellulose ethanol production.

AE Biofuels is currently evaluating sites for large-scale commercial facility construction. The company owns ethanol plant sites in Danville, IL, and Sutton, NE, and holds options for four additional permitted ethanol plant sites in Illinois.

Still more evidence that cellulosic ethanol has arrived as a biofuel is the General Motors–Coskata deal in which Coskata will use a feedstock-flexible process to convert garbage, old tires, plastic, and agricultural waste through bacterial fermentation into so-called flex fuel.

Fuel Flexibility: Flex-fuel technology, according to GM, enables a car to run on different types of fuels and different mixtures of fuels. In the case of the Saab 9–3 and 9–5 Biopower models, the cars can run on bioethanol E85, unleaded gasoline, or any mixture of unleaded gasoline and bioethanol E85, in any proportions.

GM, among the world’s largest automakers, will receive cellulosic ethanol from Coskata in late 2008 and begin testing it, according to an announcement. Coskata plans to open a 40,000-gallon facility at the end of 2008, according to Wes Bolsen, vice president for business development. “We will go from that facility to a 100-MMgy ethanol facility that we will break ground on this year,” he said in the announcement. “We look to put as much as 10 billion gallons of ethanol on the market by 2022.”

Coskata will use proprietary microorganisms to extract nearly all the energy value from a biomass-based synthesis gas stream. The process will also recycle wastewater and reduce carbon dioxide emissions. Coskata claims it can produce ethanol for under $1 per gallon. The process will keep production costs down by using local waste materials. Bolsen said he envisions locating Coskata’s plants next to traditional corn-based ethanol plants, “taking in additional agricultural waste to make those plants more efficient,” he said.

Figure 1. ()

Feedstock Flexibility: The microorganisms are key, he said. The gasification system permits the feedstock flexibility. “You can put pretty much anything in it,” he said. “The microorganisms are very, very efficient at converting it, and then we have some patented processes on the back end to separate the ethanol from the water.”

Having the clout and funding of GM behind the technology is a big advantage. “They want the rapid commercialization of this next generation of ethanol,” said Bolson. Another top-tier automaker — Toyota — announced that it is conducting in-house research on the feasibility of producing wood-based ethanol (3).

Policy Impact

For all the development strides being made so quickly, energy unfortunately is not a commodity driven solely by technology advances. National and international policies play a big role in gating development.

On the policy front, the Energy Independence and Security Act of 2007 has clearly primed the technology pump, based on the projects previously described, which are but a few of a greater and global effort. One result of the recent boom in ethanol production is the linking of the agriculture and energy sectors “in an unprecedented fashion,” according to Wallace Tyner, a Purdue University (West Lafayette, IN.) professor of agricultural economics.

“Oil and ethanol are both big players in agriculture,” he said. “In the future, they will march together, and their march will depend upon government policies.”

Tyner and other Purdue researchers have developed a model, based on variable oil prices, that predicts the impacts of federal economic policies on future consumer and government costs, ethanol production, and other aspects of the two sectors.

“We are living through a revolution in American agriculture,” said Tyner in a Purdue report. He presented his findings in February at the annual meeting of the American Association for the Advancement of Science in Boston (4).

Quantity Impact: Tyner said the prices of corn and crude oil, which before 2007 fluctuated almost independent of one another, have become more closely linked thanks to the use of massive quantities of corn to make ethanol. This year that’s about one-third of the total national harvest, according to the Purdue report.

The model shows that the fixed 51-cent-per-gallon subsidy paid to ethanol producers will become increasingly expensive for the federal government as oil prices and levels of ethanol prod

uction rise.

One alternative policy option — a variable subsidy that changes relative to crude oil prices — would be paid by the government only when crude oil sinks to less than $70 per barrel. When oil prices are higher, ethanol production should be profitable and would not need to be subsidized, Tyner predicted.

Four Options: Tyner analyzed four policy options — the current 51-cent fixed subsidy, the variable subsidy, no subsidy, and a renewable fuel standard — at oil prices ranging from $40 to $120 per barrel. The renewable fuel standard contained in the 2007 Energy Act mandates that energy companies purchase 35 billion gallons of ethanol by 2022, with a maximum of 15 billion gallons coming from corn.

“Regardless of the policy, results become similar at high crude oil prices where the market dominates,” Tyner said. “At low oil prices, however, government policies have huge effects, and all the results are enormously different. The policy choices we make will be critical.”

Fixed and Variable Subsidies: Tyler presented the following calculations at the Boston meeting regarding fixed and variable subsidies. With oil at $40 per barrel, for example, ethanol production is not profitable without a subsidy or higher fuel costs. With a fixed or variable subsidy in effect at this oil price, the government spends $5 billion per year to subsidize ethanol production. Ethanol is considerably more expensive than fuel made from petroleum in this scenario. But with the renewable fuel standard in effect, fuel companies are required to buy 15 billion gallons of corn ethanol per year. At $40 crude, the standard would cost consumers an extra $12 billion per year at the pump.

When oil surpasses $100 per barrel, however, the renewable fuel standard costs consumers little or nothing extra. That’s because at this price, ethanol production costs are very close to gasoline production costs.

With the fixed subsidy in effect, ethanol production ranges from 3.3 billion gallons a year at $40 oil to 17.6 billion gallons at $120 oil. The variable and no-subsidy policies yield 6.5 billion gallons at $80 oil and 12.7 billion for $120 oil.

Eventual Stability: Predictions from Tyner’s model point to a time in the future, roughly 2020, when gasoline and ethanol pricing follow a more stable long-run pattern, he said.

However, two independent studies reported earlier this year have indicated that clearing land to produce biofuels will stimulate global warming more than using gasoline or other fossil fuels. Policymakers will have to consider that factor in future efforts to develop incentives and watch to see technologists’ efforts to overcome this hurdle.

For the time being, however, it’s full biogenerated steam ahead. And fuel is hardly the only application area: Plastics, pharmaceutical manufacturing, food ingredients, and fine chemicals are all being reexamined in the biotech light.

Biobased Fuels, Plastics, Energy

Bioscience company Metabolix Inc. (Cambridge, MA, www.metabolix.com) for example, is developing a proprietary platform technology for producing not just biofuels, but also plastics and chemical products based on such biomass energy crops as switchgrass.

The company announced in February the start of a program to develop an advanced industrial oilseed crop for use in bioplastics. Oilseeds are the primary feedstock for the more than 250 million gallons of biodiesel produced annually in the United States. The coproduction of bioplastics in intended to improve the economics of this crop industry.

It’s a big business opportunity: More than 350 billion pounds of plastic were consumed worldwide in 2003, and the forecast is for growth of more than 5% annually, to reach some 500 billion pounds in 2010, according to the company.

Metabolix is collaborating with oilseed experts at the Donald Danforth Plant Science Center, a not-for-profit research institute in St. Louis, MO (www.danforthcenter.org). The collaboration is supported by a two-year, $1.14-million grant from the Missouri Life Sciences Trust Fund to the Danforth Center.

In-Crop-Plant Production

Metabolix is also focused now on commercializing its Mirel bioplastics, made through the conversion of agricultural products such as sugars and oils using microbial biofactories. The company said it is working to produce bioplastics directly in nonfood crop plants, with economics that will enable bioplastics to serve as viable, sustainable alternatives to such large-volume, general-purpose plastics as polystyrene, polyethylene, PET, and polypropylene.

Archer Daniels Midland (ADM, www.admworld.com), one of the world’s largest agricultural products processors and industrial fermentors, has been partnering with Metabolix since 2004 to develop bioplastics using microorganisms to convert sugars and vegetable oils into a range of compositions with a variety of properties.

Metabolix is targeting the production of these bioplastics in crops that can also provide energy based on the residual biomass. In this way, bioplastics benefit from economies of scale associated with energy production while biomass-based energy is made economic by the high-value bioplastics produced. This concept is the basis of the “Biomass Biorefinery” program, a $15 million program sponsored by the US Department of Energy, now in its fourth year, and Metabolix has also received support from the US Department of Agriculture.

Pharmaceutical Manufacturing

Today, many pharmaceuticals are semisynthetic molecules, meaning that part of their structure is created from a living organism and later modified by chemical processing. Industrial biotechnology uses biocatalysis and water replacement of organic solvents to contribute to cleaner production of such semisynthetic drugs. These processes are more profitable and greatly reduce hazardous waste production.

Plant-derived glycosides and their analogs, for example, have the unique ability to stimulate antigen-specific CTL (cytotoxic T lymphocyte) production that will seek and destroy cells carrying abnormal markers, such as viral, intracellular parasites, or tumor markers.

Bio-Synthesis Inc. (Lewisville, TX, www.biosyn.com) announced in January a collaboration with immune agonist expert Dante Marciani, whose work has involved proprietary immune stimulatory saponins and their semisynthetic analogs that have immune-enhancing activities. These small-molecule constructs can stimulate Th1 (a distinct type of T-helper cell) immunity, making them an important element in preventative vaccines as well as active immunotherapy.

Previous work by Marciani has been effective in stimulating a protective preventive immune response in commercial products, against such pathogens as retroviruses. These molecules have the capacity to stimulate both humoral and cell-mediated immunity. Their inclusion in vaccines may yield a safe and protective immune response against infection.

Immunity Synergy: The collaboration focuses on proprietary novel glycosides that stimulate innate immunity while taking advantage of the synergistic effects between innate and adaptive immunity. In addition, the collaboration extends to proprietary compounds that down-regulate Th1 immunity, an area of significance in the treatment of chronic inflammatory conditions.

Treatments that include semisynthetic molecules are commercially available, and some established drugs are being reengineered to include them. Italian drug maker Indena SpA (Milan, Italy, www.indena.com), for example, is building a plant to make semisynthetic Paclitaxel. The semisynthetic active principle will be marketed alongs

ide the natural Paclitaxel, according to the company.

Indena’s focus is the identification, development, and production of active principles derived from plants for use in the pharmaceutical, health-food, and cosmetics industries. The company in May 2007 inaugurated a high-containment plant for the production of cytotoxic semisynthetic ingredients, according to an announcement. Indena said that it makes semisynthetic Paclitaxel using a proprietary process based on a molecule extracted from yew trees, which the company cultivates. The molecule acts as an intermediate for production of various antitumor molecules, including Paclitaxel, Docetaxel, and others, on which the company is still experimenting.

Fine Chemicals

Another new facility — this one in France — has been launched for the pilot production of biobased chemicals. Among these is 1,3-propanediol (PDO), a proprietary product of METabolic EXplorer (Clermont-Ferrand, France, www.metabolic-explorer.com), which is focused on the biomanufacturing of bulk chemicals. The company has chemical product programs targeting such markets as fibers, resins, cosmetics, detergents, solvents, plastics, and biofuels.

INDUSTRIAL BIOTECHNOLOGY SESSIONS AT THE 2008 BIO INTERNATIONAL CONVENTION

The 2008 BIO International Convention offers many sessions to tell you more about these exciting areas of research and development. Here are only a few!

Feed

Science You Can Eat: The Rise of Functional Foods

Commercializing Genetically Engineered Food Animals

Growing Solutions to Climate Change: How Agricultural Biotechnology Can Help Crops Flourish With Less Water

Sustainable Agriculture in Africa

Agbiotech Development in Asia: Biotech Cotton and Rice in India and China

Biotech Crops in Centers of Origin: The Case of Corn and Mexico

Fuel

Blurring the Lines Between White and Green Biotechnology

Alternative Energy Resources in India Through Biotechnology

The DOE Energy Bioenergy Research Centers: Transformational Science Fueling the Future

What Is New in Renewable Feedstock Beyond Fuels

The Business of Climate Change

Realizing Lignocellulosic Biofuels: Socioeconomic, Environmental and Policy Challenges

Improved Pharmaceutical Manufacturing Through Controlled Enzyme Evolution

Heal (selected sessions — see also those listed in Chapter 1)

Antibiotic-Resistant Staph Infections: Challenges and Progress

Glycoscience for Innovative Medicines: A Case Study in Japan

Cross-Border Deals in Emerging Markets

Nanomedicine: Nanosensors and Nanodevices for Human Health Management

In-sourcing Innovative Products from Asia and South America

The New Kids on the Block: Alternatives to Monoclonal Antibodies

Confronting the Obesity Epidemic: The Skinny on Innovative New Treatments

Innovative Business Models to Balance Developed World Revenues with Developing World Access

The Challenges of an Ageing Population

Moore’s Law for Biomanufacturing: Innovation in a Maturing Biologicals Industry

Industry and Academia: Love Story or Dangerous Liaison

Technology Transfer and the Biotech/Pharma Industry— Establishing a New Era of Collaboration

The Early Bird Gets the Worm: Extracting Value Out of Your Early-Stage Pipeline

What Every Licensing Professional Should Know About University Licensing and Spin-Outs

DuPont scientist Paul Vitennan develops biocatalysts for the company’s cellulosic ethanol biorefinery program in Wilmington, DE ()

PDO is a polyester fiber chemical used in textile applications. METabolic Explorer’s technology for producing the chemical involves conversion of crude glycerin into PDO at high yield using a coenzyme B12 independent metabolic pathway, according to the company. The technology involves developing tailored cell factories for chemical production using renewable feedstocks, according to company documents.

A US patent for the method was granted in January, following the granting of a European patent. The technology comprises three core platforms:

A bioinformatics platform built on the proprietary database, Metavista, which includes a metabolic pathway database as well as software tools for design, analysis, and modeling of bacterial metabolic pathways

A strain-engineering platform featuring recombinant DNA technology as well as a proprietary in vivo molecular evolution technique called Metevol

An analytical platform including NMR and mass spectroscopy as well as the company’s Flux Vision for metabolic flux analysis.

METabolic EXplorer is applying the technology in three programs that comprise programs in 1.2 Propanediol (MPG) and in butanol, in addition to the PDO program. MPG is a bulk chemical used in cooling applications. It is also a component of unsaturated polyester resins used in such basic goods as furniture and bathware.

The butanol program involves production of the chemical from starch, much the way ethanol is made. The company anticipates a 50% savings through its technology in the production of butanol, which is used in paints, coatings and solvent applications.

METabolic EXplorer is conducting strain optimization and is planning to conduct the industrialization process of these products this year. The first sales from its most advanced programs are anticipated in 2011.

REFERENCES

1.) 110th Congress of the USA Energy Independence and Security Act of 2007.

2.) The Sun Grant Initiative.

3.) Kanellos, M.Toyota Branches Out into Ethanol.

4.) Tyner, WE. 2007. Policy Alternatives for the Future Biofuels Industry. J. Agric. Food Ind. Org. www.bepress.com/jafio/vol5/iss2/art2 www.agecon.purdue.edu/papers). See also Tyner WE, Taheripour F. Future Biofuels Policy Alternatives. Presented at the Biofuels, Food, and Feed Tradeoffs conference, St. Louis, MO, 12-13 April 2007; sponsored by Farm Foundation, USDA Rural Development, and USDA’s Office of Energy Policy and New Uses 5.

You May Also Like