July-August 2024

This special summer issue serves as an “expression platform” for as many different industry voices as we could squeeze in between our front and back covers. To get even more points of view than our authors could provide, we used a reader survey. The results elucidated in this section begin to outline broadly the current working environment of some 200 readers who responded. Here, our discussion centers on drug-substance manufacturing. The introductions that lead the remaining sections expand that view to encompass drug-product development, advanced therapies, and business operations.

After our survey results, Enzene’s Himanshu Gadgil touts the potential for continuous production as a means to cut down manufacturing costs while maintaining biopharmaceutical drug-substance quality. Then authors from Cygnus Technologies (part of Maravai LifeSciences) feature an improved sample-preparation method for detecting host-cell proteins using liquid chromatography with mass spectrometry. And authors from Samsung Biol...

Emerging biotechnology companies often are at the forefront of pharmaceutical innovation. Small companies develop novel molecules and complex biologics that advance global healthcare and improve patient outcomes. However, the complexity of such molecules hinders their production, increasing the cost of manufacturing and the final-product price. Unfortunately, this means that life-changing therapies are often inaccessible to patients — a problem that is amplified on a global scale because of discrepancies in healthcare systems. There are many other challenges in biologics production, but some continuous manufacturing strategies can provide solutions that improve access equity across global healthcare systems.

Biologics are often large and complex molecules, requiring a multistep process with several interconnected stages. First, cell-line engineering is used to express a gene of interest (GoI). That is followed by upstream and downstream processing, formulation, and fill–finish, with each step requiring op...

Host cell proteins (HCPs) can copurify with biological drug substance (DS) and pose potential risks for both patients and drug manufacturers by causing immunogenicity, diminishing DS efficacy, and/or compromising DS stability. Thus, the quantity and nature of residual HCPs in DS generally are considered to be critical quality attributes (CQAs). Enzyme-linked immunosorbent assays (ELISAs) are the gold-standard analytical method for measuring total HCP levels to support both in-process testing and product release. Liquid chromatography with mass spectrometry (LC-MS) has emerged as an orthogonal tool for better understanding of HCP properties and thus more effective removal.

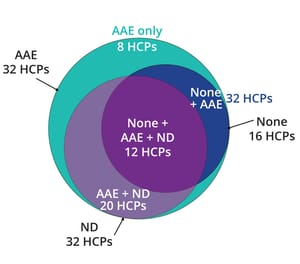

MS is a powerful complementary method to demonstrate ELISA suitability. When combined with antibody affinity extraction (AAE) technology using an HCP ELISA antibody, MS can be used to demonstrate that an HCP ELISA is suitable for monitoring purification process consistency and product lot release (

1

).

A major challenge for LC-MS–based ...

Chemistry, manufacturing, and controls (CMC) are critical components that embody the entire development of a client’s drug product. Samsung Biologics has searched fervently for and ultimately sculpted its own customized CMC service based on strongly connected and seamless ideologies designed to close the gaps between development and commercialization. That must be achieved by meeting a client’s requirements exactly. Doing so has proven to be challenging for many CDMOs, especially because client needs change over time. Samsung Biologics addresses such challenges with its SelecTailor platform, an optimized scope-determination process in which we map out a coherent narrative of services to accommodate all possible needs.

Problems arise for some clients, when they do not fully understand their molecule and the developmental regulations that are relevant to their goals. Such uncertainties can lead to dead stops in determining the scope of work (SoW) or result in change requests (CRs) that go beyond the establi...

This special summer issue serves as an “expression platform” for as many different industry voices as we could squeeze in between our front and back covers. To get even more points of view than our authors could provide, we used a reader survey. The results elucidated in this Drug Product section continue to outline broadly the current working environment of some 200 readers who responded with a focus on formulation, fill–finish, drug-delivery, characterization, analysis, and other drug-product concerns.

After our survey results, authors from the Indo US Organization for Rare Diseases and Jeeva Clinical Trials highlight the need for governments, industry leaders, and advocacy groups to work together in allocating resources and streamlining regulatory processes for developing effective treatments for patients with rare diseases. BPI managing editor Brian Gazaille explores the coming together of therapeutics and diagnostics for cancer immunotherapy with Ofer Sharon of OncoHost.

BPI often makes a distinction...

Rare diseases represent a diverse group of disorders (~11,000), each one affecting a small fraction of the population. Despite their individual rarity, rare diseases impact ~400 million people globally and pose significant challenges for patients, healthcare providers, and drug developers alike. Historically, the development of rare-disease treatments has been slow and often neglected because of limited pathological understanding, small patient populations, and high costs associated with research and development (R&D). However, recent years have witnessed a revolution in rare-disease research, driven by technology advancements, increased collaboration, and a growing recognition of unmet patient needs.

Advancements in Rare-Disease Research

Rare-disease researchers have made remarkable progress by using innovative technologies such as artificial intelligence (AI) and establishing collaborative initiatives around the globe.

Genomics and Precision Medicine:

Next-generation sequencing (NGS) has transformed ge...

Immune-checkpoint inhibitors (ICIs) represent a promising approach to treating malignant cancers. For instance, monoclonal antibodies (mAbs) can be designed to disrupt interactions between programmed–cell-death receptor 1 (PD-1) proteins expressed on T cells and associated ligand 1 (PD-L1) proteins on the surfaces of tumor cells. Such interactions are known to activate immune cascades that result in T-cell dysfunction and exhaustion, enabling cancer cells to slow down T-cell activity. In theory, applying a PD-1 or PD-L1 inhibitor should reverse the immune checkpoint and “release the brake” on T-cell responses, promoting cancer destruction. PD-1/PD-L1 blockade forms the basis for seven US Food and Drug Administration (FDA)–approved biologics, and two other approved products apply the same principle to cytotoxic T-lymphocyte–associated protein 4 (CTLA-4) (

1

). Several related targets and modalities are under clinical evaluation, too (

2, 3

).

ICIs offer hope to patients as first-, second-, and later-line t...

This special summer issue serves as an “expression platform” for as many different industry voices as we could squeeze in between our front and back covers. To get even more points of view than our authors could provide, we used a reader survey. With a focus on cell and gene therapies (CGTs), the results elucidated in this section continue to outline broadly the current working environment of some 200 BPI readers.

Herein, consultants from Latham BioPharm Group and Apprentice.io present a vision for the future of smart technologies in good manufacturing practice (GMP) production of advanced therapies. Also, Matthew Durdy describes the important role that innovation organizations such as the Cell and Gene Therapy Catapult can play in building just such a future. And we welcome our section sponsor, Sartorius, to share this space with us.

But first, we summarize some answers from respondents to our reader survey who are involved in advanced-therapy work — and, as elsewhere, thank them for their participation ...

By the end of 2023, six gene-modified cell therapy products had received regulatory approval for treatment of aggressive B-cell lymphomas, mantle-cell lymphomas, B-cell acute lymphoblastic leukemia, and most recently, multiple myeloma. Such personalized medicines leverage patient-derived T cells that are genetically engineered to express chimeric antigen receptors (CARs) for recognition of a specific tumor antigen (e.g., CD19 proteins). Engineered cells are expanded and then are reinfused back into the patient as a CAR T-cell therapy. Building on the success of CAR-T as a modality, more than 2,000 clinical trials remain active worldwide for CAR-T candidates, including more than 200 programs in phase 3 studies (

1

).

However, access to such life-saving therapies remains limited. Although treatment costs represent a major barrier, another factor is that current cell-therapy manufacturing processes cannot meet the high market demand for such products. Healthcare analysts estimate that the global patient popu...

Advanced-therapy medicinal products (ATMPs) hold much promise for patients living with cancers and rare diseases. In the future, increased availability of cell and gene therapies also could ease the burden of disease on national healthcare systems such as the UK National Health Service (NHS). Such potential has attracted significant business interest and investment within the ATMP sector. The Cell and Gene Therapy Catapult (CGT Catapult) seeks to facilitate and accelerate industry growth by supporting efforts to overcome technological and process barriers throughout advanced-therapy development and manufacturing. Our organization also trains life-science professionals to help them acquire new skills and equips companies with the tools needed to develop impactful medicines.

Enabling ATMP Development

Innovative treatments could reap significant savings for healthcare systems by reducing or eliminating the need for costly long-term care for a breadth of conditions that currently have high unmet medical needs...

This special summer issue serves as an “expression platform” for as many different industry voices as we could squeeze in between our front and back covers. To get even more points of view than our authors could provide, we used a reader survey. Results elucidated in this Business Operations section continue to outline broadly the current working environment of some 200 readers who responded by focusing on staffing/training, outsourcing/partnering, data management, regulatory compliance, and sustainability.

In this section, BPI editorial advisor Jared Auclair shows how vocational schools and the biopharmaceutical industry can collaborate to build a future workforce. Consultant Filippo Pendin overviews the commercial journey of outsourced biologics. Oklahoma State University professor Sunderesh Heragu highlights opportunities presented by current supply chain challenges. BPI managing editor Brian Gazaille discusses industry 4.0 acceptance and implementation with consultants from CRB Group. Authors from Ric...

It is a common misconception that professionals need a doctorate or other advanced degree to work in biotechnology and life sciences. But many career opportunities in the industry are available to people who have not attended a four-year college. Graduates of high schools and vocational schools often possess the skills and certifications needed to work in the life-sciences industry. And although college and postsecondary degrees remain important to some job seekers, many others can benefit from more accessible pathways that enable workers to thrive in the sector.

The Cost of College

College tuition costs can impose crippling financial burdens to students, particularly in the United States, which as a country has US$1.75 trillion in student loan debt, with an average of $30,000 owed per borrower (

1

). Society conditions us to aspire to a college education after high school, but few people examine the return on investment from earning a college degree. According to

Inside Higher Ed

, although there is a p...

The journey for biotechnology companies and contract development and manufacturing organizations (CDMOs) from research and development (R&D) to market commercialization is marked by both opportunities and challenges. Biotechnology companies can rely on outsourced partners to improve efficiencies and speed up development. Those CDMOs must ensure process control and quality excellence and move nimbly to raise capital and drive success.

Stages in Developing a Biologic Product

In the tough capital market, biotechnology companies often struggle to raise enough funds to develop new candidates efficiently. Such difficulties also hinder biologics developers and CDMOs from raising the money needed for manufacturing optimization and scale-up.

Capital raising in the biologics sector is characterized by formidable challenges. The development costs associated with biologics are staggering. Such costs encompass R&D, clinical trials, current good manufacturing practice (CGMP), and regulatory compliance, making biologic ...

In the 1930s and 1940s, celebrated quality-management expert W. Edwards Deming developed 14 points to help manufacturers improve the quality of their products (

1

). His fourth point encouraged working with a single supplier of a given material to minimize total cost, improve quality, and increase productivity. Although American, European, and Asian (especially Japanese) manufacturers of automobiles and industrial products have followed that principle for more than 70 years, it was put to the test during and just after the COVID-19 pandemic. The principle reached a limit when automobile manufacturers needed to stop production because of semiconductor-chip shortages (

2

). All other components could be sourced from multiple vendors, but chips had come from single suppliers. Subsequent shutdowns led to sales losses for suppliers and manufacturers while increasing costs to consumers. Because of limited supply and high demand, prices for new and used cars went up significantly, contributing to high levels of...

Biopharmaceutical manufacturers continue to weather the sea change associated with industry 4.0. Although “smart” capabilities seemed urgent to develop during the COVID-19 pandemic, results from BPI’s Platform issue survey indicate that few companies have made headway in doing so. Respondents agreed that smart technologies can enhance operational speed and flexibility. But many companies are shifting resources to address different priorities, while other companies are reluctant to sail further into the digital-manufacturing environs.

Early in 2024, I corresponded with Yvonne Duckworth (a fellow in digital technology at CRB) and Ryan Thompson (a senior specialist in industry 4.0 at CRB) about their experiences with establishing industry 4.0 capabilities. Duckworth and Thompson identified reasons for reluctance among biomanufacturers and emphasized the need for additional use cases and regulatory resources. Such information will help companies to establish corporate cultures that foster digital transformati...

Many pharmaceutical companies decide to partner with contract development and manufacturing organizations (CDMOs) for biologics production. Selection of a suitable contract partner should be driven not only by pricing and timelines, but also by fit: The best CDMOs provide comprehensive capabilities, dedicated attention to customer products, and strong, proactive communication.

Register or Login and hit Download Now to get the full article.

The biopharmaceutical industry is entering an exciting and transformative phase. Increasing demand for treatments that address unmet medical needs while remaining affordable is driving significant changes. This is reflected in rising numbers of US Food and Drug Administration (FDA) approvals for biologics each year. Biomanufacturers are expanding beyond monoclonal antibodies (mAbs) into new modalities such as cell and gene therapies (CGTs), without losing focus on the substantial market potential of mAbs.

Biopharmaceutical companies are tasked with balancing the development of new therapeutic modalities and reducing manufacturing costs while maintaining environmental responsibility. Efforts are underway for improving process robustness and efficiency and creating more flexible manufacturing facilities that can accommodate diverse biological products. Key strategies include adopting single-use technologies, implementing process-intensification and continuous-manufacturing strategies, enhancing process anal...

On Tuesday afternoon, 4 June 2024, consultants from BDO USA brought together a

panel of leaders

from up-and-coming biopharmaceutical companies to examine “make or buy” decision-making for manufacturing of advanced therapies. Moderator Stephen Orosz (managing director at BioProcess Technology Group, BPTG, part of BDO USA) led the discussion with Heikki Jouttijärvi (senior vice president of manufacturing and supply chain management at Adverum Biotechnologies), Adam Haskett (senior director and head of external manufacturing for Cargo Therapeutics), David Fontana (chief business and operating officer at Umoja Biopharma), and Brad Stewart (market managing principal and national life-sciences leader at BDO USA).

Three of the panelists were executives from companies that make cell and gene therapies (CGTs). Orosz explained that such products present significant challenges related to cost, complexity, quality, and lead times — all of which sponsors consider when deciding whether to outsource or build in-house ...

During the 2024 BIO International Convention in San Diego, CA, Dan Stanton (editorial director at Informa Connect Life Sciences) moderated a

panel of experts

from biotechnology companies who addressed ongoing news in biomanufacturing and how recent developments in the space stand to affect the industry. Stanton was joined by Ninette van Lingen (senior vice president in business development at Just–Evotec Biologics), Sundar Ramanan (chief quality officer at Enzene), and Brad Stewart (national leader for life sciences at BDO USA).

COVID Market Fluctuations

Stanton led the discussion by reflecting on how biomanufacturing demands spiked during the COVID-19 pandemic. Business rose for many suppliers and contract development and manufacturing organizations (CDMOs) before demand normalized 18 months ago, leading to a general decline. Stewart acknowledged the difficulty that such a shift caused for many companies.

“Those of us who’ve been in this industry for a long time, we see these cycles, boom and bust.” He...

Although expression titers have increased significantly since the 1990s, biopharmaceutical scientists still have much to learn about engineering cell lines for biologics manufacturing, especially as therapeutic proteins grow in diversity and complexity. At the BPI Theater during the 2024 BIO International Convention,

BioProcess Insider

editor Millie Nelson moderated a

panel discussion

about strategies for improving cell-line development (CLD). Conversation focused especially on how advanced computational tools, including some based on artificial intelligence/machine learning (AI/ML), could enhance host-cell genome engineering and protein design. Joining Nelson were Larry Forman (chief executive officer (CEO) of cell-line engineering company CHO Plus), Nathan Lewis (professor of pediatrics and bioengineering at the University of California in San Diego, UCSD), and Steve McCloskey (CEO of Nanome).

Engineering for Predictable Protein Expression

Nelson asked first about designing cell lines for maximum yi...

On Wednesday afternoon, 5 June 2024, contract research organization (CRL) Charles River Laboratories (CRL) held a

panel discussion

as part of the BPI Theater at the Biotechnology Innovation Organization’s (BIO’s) annual convention in San Diego, CA. Moderator Nicholas Ostrout (CRL’s senior director of strategic accounts and partnerships) led the conversation with panelists Jesse McCool (cofounder and chief executive officer of Wheeler Bio), Ian Wyllie (CRL’s director of RightSource operations), and Sam Chuang (senior director of the scientific advisory services group at CRL).

In March of this year, CRL and contract manufacturer Wheeler Bio announced a partnership “to help clients expedite their drug development journey from discovery and CMC [chemistry, manufacturing, and controls] development to manufacturing” of antibody-based biotherapeutics. The alliance combines CRL’s experience in discovery, safety, and analytics with Wheeler’s “Portable CMC” platform for biotherapeutics discovery to investigationa...

As effective automation systems and supportive technologies emerge, biopharmaceutical companies are beginning to explore the feasibility of continuous biomanufacturing (CB). On the second day of the BPI Theater at the 2024 Biotechnology Innovation Organization (BIO) International Conference in San Diego, CA,

BioProcess Insider

editor Millie Nelson moderated a

panel discussion

about CB implementation with Jon Gunther (vice president of business development at Just–Evotec Biologics) and Sundar Ramanan (chief quality officer at Enzene Biosciences). Both panelists’ companies are contract development and manufacturing organizations (CDMOs) that have established platforms for continuous biologics production. The trio discussed factors that might convince other drug manufacturers to transition from traditional fed-batch (FB) processes to operations based on CB.

Accelerating Development To Expand Patient Access

Nelson pointed out that patient access remains limited for many biologics. Global demand for such d...

Dawn Ecker

, managing director, bioTRAK database services, BDO USA

For nearly two decades, Ecker’s team has leveraged its bioTRAK database to monitor business trends in recombinant-protein manufacturing. On the supply side, the database tracks bioproduction capacity across 240 facilities and 140 companies for products that will reach US and EU markets. It contains information about all available bioreactors, including appropriate expression technologies, scales, applications (clinical or commercial production), equipment formats, production locations, and operational statuses. The database also tracks capacity demand, gathering information about active drug programs and their modalities, development phases, production hosts, volumetric demand per year, manufacturing locations, and drug-product requirements.

Ecker highlighted

several use cases for the database. Its supply-related data facilitate competitor analyses, evaluations of potential site acquisitions, and selection of contract manufacturers. The d...

Strategies for Integrated Development and Manufacturing: Adapting Batch Platforms and Facilities for Multimodal Biopharmaceutical Production and Continuous ProcessingStrategies for Integrated Development and Manufacturing: Adapting Batch Platforms and Facilities for Multimodal Biopharmaceutical Production and Continuous Processing

David Jen

, principal consultant, Bioblue CMC Manufacturing Consulting

Mohammed Albadrani

, San Diego office lead, Wunderlich-Malec Engineering

Bioblue CMC Manufacturing Consulting began operations in 2023, focusing on process-development manufacturing and validation for protein biologics and cell and gene therapies (CGTs), as well as management for contract development and manufacturing organizations (CDMOs). The company works with a breadth of biologics, including antibodies, viral vectors, adenoassociated viruses (AAVs), and chimeric antigen receptor (CAR) T cells. To complement Bioblue’s services, Wunderlich-Malec provides engineering support to life-science companies. Established in 1981, the latter company offers expertise in system integration and automation, process design, and project management. Bioblue and Wunderlich-Malec have begun a partnership to develop a solution for continuous bioprocessing.

Recent observations in facility use were the driving force for seeking a solution to integrated c...

Ramin Baghirzade

, senior director and global head of commercial gene therapy services, Charles River Laboratories

The cell and gene therapy (CGT) sector has reached a significant turning point. Between 2017 and 2022, regulatory agencies approved only five gene therapies. But in 2023 alone, five more were approved. The Alliance for Regenerative Medicine (ARM) predicts another record year for 2024, estimating approval for up to 14 gene-therapy products by the European Medicines Agency (EMA) and/or the US Food and Drug Administration (FDA). “It’s a great time to be in the industry,” Baghirzade said. Gene therapy is “no longer science fiction, it’s becoming a reality.”

Despite the industry enthusiasm, drug developers and contract development and manufacturing organizations (CDMOs) still face conflicts with one another about how to approach CGT production.

Baghirzade described

two common interactions that cause friction between the two entities: Sometimes drug developers approach CDMOs to create products wi...

Larry Forman

, founder and chief executive officer, CHO Plus

Forman gave a unique perspective

on the states of cell-line development and engineering for adenoassociated virus (AAV) as someone not trained in those fields. The viral-vector space is oversaturated with contract development and manufacturing organizations (CDMOs), he stated, with few technological differences to distinguish them from one another. Such CDMOs experience universal challenges with low productivity, low ratios of full-to-empty AAV capsids, and suboptimal product quality — not to mention the inability to keep up with demand efficiently. Viral-vector manufacturing requires 10-L production capacity to make enough material for the treatment of a single patient who suffers from a common monogenic disorder. To treat a million patients, manufacturers would need to run hundreds of thousands of such processes — or to scale production significantly in stainless-steel bioreactors.

Forman began CHO Plus to explore methods of improving therape...

Sundar Ramanan

, chief quality officer, Enzene Biosciences

Enzene offers a novel platform for commercially available, fully connected, continuous manufacturing (FCCM) platform. Traditional fed-batch manufacturing comes with many challenges that hinder biologics development. Independent operations use multiple large bioreactors and holding tanks, resulting in inefficient set ups and high inventory costs. Manual intervention and large facility carbon footprints lead to unsustainable manufacturing solutions, making compliance and contamination control difficult to manage. High capital costs render fed-batch production impractical for small, emerging biotechnology companies needing to expedite molecule development. And many people around the world have limited access to biologics.

Ramanan said

that such concerns could be addressed by adopting technologies for FCCM.

FCCM is an automated manufacturing method in which process fluids seamlessly flow from upstream to downstream phases. An FCCM platform such as t...

Madison Hoal

, senior global technical consultant, Ecolab Life Sciences

Hoal presented the audience with a question

: What challenges do you encounter in your contamination-control processes? Robust cleaning, disinfection, and biodecontamination are all crucial to preventing microbial contamination related to manual manipulations throughout biopharmaceutical manufacturing. The EU Annex 1 for good manufacturing practice (GMP) requires contamination-control strategies to be documented for sterile manufacturing processes. Such strategies should be based on scientific justification and quality risk management (QRM) principles to mitigate the ingress of contamination into drug products. Contamination-control strategies must include detailed assessments of the design and controls of facilities, equipment, systems, and procedures.

“You don’t need to have a full document to identify contamination risks,” Hoal said. “Just [by] walking the manufacturing floor, you can see contamination risks.” Such risks can includ...

Himanshu Gadgil

, chief executive officer, Enzene Inc., USA

Enzene began operations in 2015 based on an important question: How do we democratize access to lifesaving medicines in India? Whereas a gram of gold costs about US$80–90, a purified monoclonal antibody (mAb) drug substance can range from $150/g to $450/g. Cancer therapies can cost $10,000— 20,000/g. Consider that 99.8% of Indian households earn under $2,000 per month and that 22% earn under $60 per month. Almost no patients in India can afford lifesaving treatments, and drug manufacturers struggle to maintain production in Indian facilities. Biosimilars and other biologics are produced in only small quantities because of their high fixed costs.

Key contributors to fixed costs include utilities, facility maintenance, employee salaries, facility amortization, and equipment depreciation. Amortization and depreciation specifically can contribute up to 50–60% of fixed costs for biologics production.

Gadgil noted

that in such a high-cost environment...

Kevin Zen

, senior director, IGM Biosciences

Manufacturers of monoclonal antibodies (mAbs) and other therapeutic proteins are heeding calls from regulatory agencies to shift from off-line to on-line and/or in-line (OL/IL) measurement of critical quality attributes and process parameters (CQAs, CPPs). But developers of cell and gene therapies (CGTs) still rely on off-line methods. Industry collaboration is necessary to develop sufficiently sophisticated technologies for monitoring of complex CGT quality attributes.

Zen explored

recent advances in analytical instrumentation for applications involving mAbs and gene therapies delivered by adenoassociated virus (AAV) vectors.

Zen began with discussion of process analytical technologies (PATs). He noted that upstream scientists still monitor familiar process parameters such as bioreactor pH, oxygen and nutrient consumption, and so on. But as OL/IL offerings proliferate, total- and viable-cell density (TCD, VCD) are gaining in importance. Timely monitoring of ...

Subscribe to receive our monthly print or digital publication

Join our 70,000+ readers. And yes, it's completely free.