May 2023 Featured Report

In December 2022, the President’s Council of Advisors on Science and Technology (PCAST) submitted a report to Joe Biden about biomanufacturing in the United States. In a letter prefacing the report, the council cochairs noted that the bioeconomy is “poised for enormous growth over the coming decades” (

1

). On 22 March 2023, the White House Office of Science and Technology Policy responded with a set of five initiatives to help realize the potential of the nation’s bioeconomy. The broad goal is for 30% of chemicals and 90% of plastics in the United States to be produced through sustainable replacements derived from synthetic biology (

2

).

“With this revolution comes great opportunity: desirable new jobs for skilled workers, a reduced carbon footprint, and new products that will expand US manufacturing and accelerate our economy, all with the potential to enhance access to these benefits in under-served regions of the country,” the cochairs wrote in their letter (

1

). “Indeed, critical discoveries in bio...

Demand for biopharmaceuticals is growing rapidly as new products and manufacturing technologies arise. For example, such approaches as immunooncotherapy and oncolytic viral therapy are now entering one of the fastest growing markets in medicine — cancer treatment. This market “should grow from [US]$177.4 billion in 2021 to $313.7 billion by 2026, at a compound annual growth rate (CAGR) of 12.1%” (

1

).

Both preclinical and final biomanufacturing increasingly incorporate single-use (SU) components, including hardware and systems for containment and connectivity. Solutions also are increasing for portable turn-key systems, dedicated software, and process support (

2

). SU materials are available for most biopharmaceutical operations because suppliers continually offer new products and applications (

3

).

Such work has expanded SU technologies into new product modalities, manufacturing formats, and automations. In fact, the SU bioprocessing market is expected to grow from $21.98 billion in 2021 to $84.12 bil...

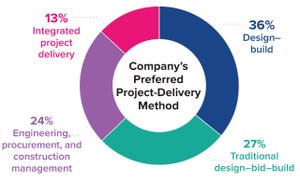

Agility, speed, and disruptiveness are now the “table stakes” in a world where the old rules governing biopharmaceutical manufacturing are being rewritten — in no small part by the COVID-19 pandemic and a new emphasis on lean project-delivery principles. All along the pharmaceutical value chain, companies, governments, and scientists worked at unprecedented speeds to mitigate SARS-CoV-2 outbreaks. Collaboration and constant communication among clients, trade partners, and vendors were critical at each step, from research and development (R&D) through commercial-scale production and distribution. Such experiences have revealed the value of

integrated project delivery

(IPD) as a holistic approach that supports facility design and construction to bring production of life-saving vaccines and therapies online without sacrificing cost, time, or quality.

But our company’s 2021

Horizons: Life Sciences

report finds that despite such benefits, the biopharmaceutical industry seems to be making halting moves towa...

HTTPS://STOCK.ADOBE.COM

Audits are a vital quality-management tool in the biopharmaceutical industry. Whether the activity is verifying supplier or partner qualifications, contributing to corrective and preventative actions (CAPAs), or fulfilling regulatory requirements, proactive auditing is key to successful operations. Over the past couple of years, virtual audits — also known as

remote

or

distance audits

— have enabled biopharmaceutical companies to maintain compliance and quality-assurance (QA) demands despite COVID-19–related travel restrictions and social-distancing protocols. Now that the world is opening up again, the benefits of virtual audits have not been forgotten, and despite their difficulties, they are likely to remain an important tool in the industry’s toolbox.

Now that regulators, subject-matter experts (SMEs), and other stakeholders can observe and review facilities on site, we might wonder what purpose virtual audits serve and what benefits still could be leveraged. Pandemic-relat...

Subscribe to receive our monthly print or digital publication

Join our 70,000+ readers. And yes, it's completely free.